SBA Lending in Arkansas Rises in 2013

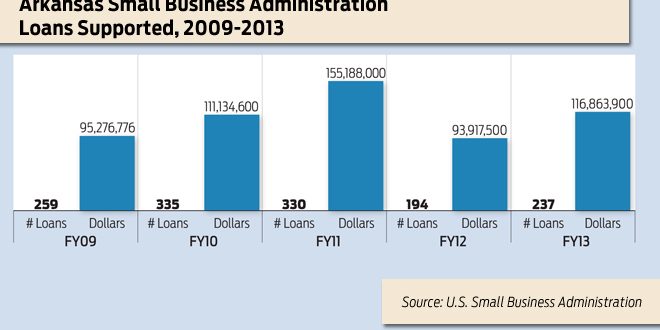

Good news for the state’s small business environment: The number of loans from the U.S. Small Business Administration is increasing nationwide, and Arkansas is no exception. In Arkansas, for the SBA’s fiscal year ending Sept. 30, 237 loans worth a total of $116 million were approved. Compare that to 2012, when it approved 194 loans for a total of $93.9 million. Linda Nelson, director of SBA’s Arkansas district, said the state’s business environment is improving and its “startup ecosystem” is developing, particularly in northwest Arkansas. Nationwide, the SBA showed similar improvement, announcing that it supported loans worth $29 billion, or 54,106 loans. SBA Administrator Jeanne Hulit credited the Obama administration for its support of small business programs. With SBA loans, the administration acts as a sort of mediator between the bank and the entrepreneur. “The bank has the money; the borrower needs money,” Nelson said. “The bank has power but they have to mitigate their risk in lending.” The banks’ risks are typically lowered by shortening the time of the loan and increasing interest, then seeking collateral. “When you shorten the term, you’re putting more risk back on the borrower,” Nelson said. “Small businesses are already risky operations, no matter what. They could be doing everything right and then the economy deals them a blow.” So the SBA offers a guaranty for the lender, reducing its risk while saving the business owner from putting more assets on the line. The SBA offers loans both for launches and expansions. In 2013, 103 went to new businesses and 134 went to existing ones. Nelson said that’s more new businesses than in previous years. “We are also seeing more activity in the SBA Express program,” Nelson said. “It’s very simple and has only a 50 percent guaranty. That gives better flexibility for the borrower, and many of them do need a line of credit versus term working capital. I think … another reason the SBA exists is that working capital is typically harder to come by for businesses than finding something tangible attached for collateral.” The most successful year during the last five for the SBA was 2011, where 330 loans were approved for a total of $155 million. Nelson said this was because, for that year, under the American Recovery & Reinvestment Act, guaranty fees were waived and loans could have a guaranty of up to 90 percent of their value. “It also gave a higher percentage to lenders, so we saw quite a bit of activity at that time,” Nelson said. “The guaranty fee we charge on a maximum-sized loan, $5 million, is over $50,000, so that was quite a savings. Lenders got a 90 percent guaranty instead of 75 percent, so that lowered their risk.” When the provisions under the Recovery Act ceased, the number of SBA loans dropped but have steadily risen since then. The largest recipients of Arkansas SBA loans in fiscal 2013 were agricultural and timber companies, accounting for $36.4 million in loans. Of the loans granted in 2013, 15 were for more than $2 million, and 67 were for less than $150,000. Going Local — or Not The SBA loan program usually works through local banks. Going into 2014, 127 lenders in Arkansas allow SBA loans, Nelson said. That isn’t all of them, of course. “What happens a lot of times is [businesses] call us and say, ‘I want to start my business,’ or ‘I need money to grow, but my bank isn’t interested,’ or ‘they don’t do SBA loans,’” Nelson said. “So we give them several alternatives.” In some situations, businesses can simply turn to an out-of-town bank. For example, Joe Davis financed the 2013 startup of his business, Joe’s Pharmacy Express in Searcy, through an SBA loan delivered by First Financial Bank of El Dorado. Through a contact, Davis discovered that First Financial frequently worked with SBA loans, so he tried the bank out, and he said that so far, “it’s been a roaring success.” Incidentally, First Financial financed 61 SBA loans in fiscal 2013, more than any other Arkansas bank. Only Arvest Bank of Fayetteville, the state’s largest by assets, came close, with 45. Nelson said business owners are often encouraged to visit the Arkansas Small Business & Technology Development Center at the University of Arkansas at Little Rock, where they can understand better how to make a business plan and can be walked through the SBA loan application process. “We also have Arkansas Capital Corp.,” Nelson said. “They do both of the kinds of loans we have, the 7(a) and the 504.” The reopening of Bruno’s Italian Bistro in downtown Little Rock was partially financed by an SBA loan through Arkansas Capital Corp., said co-owner Gio Bruno. “We bought all of our equipment with that loan,” he said. “It was essential. We couldn’t have opened without that equipment loan.” Arkansas Capital Corp. can also act as a mediator between the borrower and the SBA. Gina Radke, CEO of Galley Support Innovations of Sherwood, said her company’s recently announced expansion was made possible by an SBA loan through Arkansas Capital Corp., and the process was improved over a previous SBA loan she obtained during the recession. “That one was terribly strenuous to get,” she said of the earlier loan. “It was ridiculous. I actually went and spoke to [former] Congressman Vic Snyder and simply said, ‘Listen, this is a great program, but there’s no incentive for banks to do it; it’s not working properly.’ It took us a year and half to get that loan.” But when Arkansas Capital Corp. handled her most recent SBA loan, Radke said, communication was much better. Nelson at the SBA also said the administration has some micro-lenders that borrow money from the SBA at low interest rates and can refinance loans up to $50,000. These micro-lenders include alt.Consulting of Pine Bluff, Forge Inc. of Huntsville and Accion Texas of San Antonio, which has offices in Arkansas. Nelson said the SBA is working to improve its process and increase the number of loans approved. She said the SBA has started streamlining its main program, reducing its loan applications down to a single process instead of several disparate ones. “I think that will help bring some consistency for lenders,” she said. “That’s what they want. The smaller the bank, the more that individual loan officer is required to do.” She added that she expects to see loans coming from the Blytheville and Osceola area thanks to the coming of Big River Steel. For the future, Nelson said the SBA lending program will continue to face challenges. “A couple of our strongest banks in the state are so caught up now in acquisitions, if you will,” she said. “Like Centennial had been a big player, but their numbers have dropped off.” But it’s still a challenge to deal with those banks, she said, because they often must change systems post-acquisition, which means they won’t “be looking at SBA lending as much as we hope they will,” Nelson said. “In the meantime, we’ve seen interest from some with an already-settled footprint,” she said. “Like First Service at Greenbrier showed some interest and has set up somewhat of an SBA department. That is the model that works best.” Article by Luke Jones, Arkansas Business. Read more here: SBA Lending in Arkansas Rises in 2013

Good news for the state’s small business environment: The number of loans from the U.S. Small Business Administration is increasing nationwide, and Arkansas is no exception. In Arkansas, for the SBA’s fiscal year ending Sept. 30, 237 loans worth a total of $116 million were approved. Compare that to 2012, when it approved 194 loans for a total of $93.9 million. Linda Nelson, director of SBA’s Arkansas district, said the state’s business environment is improving and its “startup ecosystem” is developing, particularly in northwest Arkansas. Nationwide, the SBA showed similar improvement, announcing that it supported loans worth $29 billion, or 54,106 loans. SBA Administrator Jeanne Hulit credited the Obama administration for its support of small business programs. With SBA loans, the administration acts as a sort of mediator between the bank and the entrepreneur. “The bank has the money; the borrower needs money,” Nelson said. “The bank has power but they have to mitigate their risk in lending.” The banks’ risks are typically lowered by shortening the time of the loan and increasing interest, then seeking collateral. “When you shorten the term, you’re putting more risk back on the borrower,” Nelson said. “Small businesses are already risky operations, no matter what. They could be doing everything right and then the economy deals them a blow.” So the SBA offers a guaranty for the lender, reducing its risk while saving the business owner from putting more assets on the line. The SBA offers loans both for launches and expansions. In 2013, 103 went to new businesses and 134 went to existing ones. Nelson said that’s more new businesses than in previous years. “We are also seeing more activity in the SBA Express program,” Nelson said. “It’s very simple and has only a 50 percent guaranty. That gives better flexibility for the borrower, and many of them do need a line of credit versus term working capital. I think … another reason the SBA exists is that working capital is typically harder to come by for businesses than finding something tangible attached for collateral.” The most successful year during the last five for the SBA was 2011, where 330 loans were approved for a total of $155 million. Nelson said this was because, for that year, under the American Recovery & Reinvestment Act, guaranty fees were waived and loans could have a guaranty of up to 90 percent of their value. “It also gave a higher percentage to lenders, so we saw quite a bit of activity at that time,” Nelson said. “The guaranty fee we charge on a maximum-sized loan, $5 million, is over $50,000, so that was quite a savings. Lenders got a 90 percent guaranty instead of 75 percent, so that lowered their risk.” When the provisions under the Recovery Act ceased, the number of SBA loans dropped but have steadily risen since then. The largest recipients of Arkansas SBA loans in fiscal 2013 were agricultural and timber companies, accounting for $36.4 million in loans. Of the loans granted in 2013, 15 were for more than $2 million, and 67 were for less than $150,000. Going Local — or Not The SBA loan program usually works through local banks. Going into 2014, 127 lenders in Arkansas allow SBA loans, Nelson said. That isn’t all of them, of course. “What happens a lot of times is [businesses] call us and say, ‘I want to start my business,’ or ‘I need money to grow, but my bank isn’t interested,’ or ‘they don’t do SBA loans,’” Nelson said. “So we give them several alternatives.” In some situations, businesses can simply turn to an out-of-town bank. For example, Joe Davis financed the 2013 startup of his business, Joe’s Pharmacy Express in Searcy, through an SBA loan delivered by First Financial Bank of El Dorado. Through a contact, Davis discovered that First Financial frequently worked with SBA loans, so he tried the bank out, and he said that so far, “it’s been a roaring success.” Incidentally, First Financial financed 61 SBA loans in fiscal 2013, more than any other Arkansas bank. Only Arvest Bank of Fayetteville, the state’s largest by assets, came close, with 45. Nelson said business owners are often encouraged to visit the Arkansas Small Business & Technology Development Center at the University of Arkansas at Little Rock, where they can understand better how to make a business plan and can be walked through the SBA loan application process. “We also have Arkansas Capital Corp.,” Nelson said. “They do both of the kinds of loans we have, the 7(a) and the 504.” The reopening of Bruno’s Italian Bistro in downtown Little Rock was partially financed by an SBA loan through Arkansas Capital Corp., said co-owner Gio Bruno. “We bought all of our equipment with that loan,” he said. “It was essential. We couldn’t have opened without that equipment loan.” Arkansas Capital Corp. can also act as a mediator between the borrower and the SBA. Gina Radke, CEO of Galley Support Innovations of Sherwood, said her company’s recently announced expansion was made possible by an SBA loan through Arkansas Capital Corp., and the process was improved over a previous SBA loan she obtained during the recession. “That one was terribly strenuous to get,” she said of the earlier loan. “It was ridiculous. I actually went and spoke to [former] Congressman Vic Snyder and simply said, ‘Listen, this is a great program, but there’s no incentive for banks to do it; it’s not working properly.’ It took us a year and half to get that loan.” But when Arkansas Capital Corp. handled her most recent SBA loan, Radke said, communication was much better. Nelson at the SBA also said the administration has some micro-lenders that borrow money from the SBA at low interest rates and can refinance loans up to $50,000. These micro-lenders include alt.Consulting of Pine Bluff, Forge Inc. of Huntsville and Accion Texas of San Antonio, which has offices in Arkansas. Nelson said the SBA is working to improve its process and increase the number of loans approved. She said the SBA has started streamlining its main program, reducing its loan applications down to a single process instead of several disparate ones. “I think that will help bring some consistency for lenders,” she said. “That’s what they want. The smaller the bank, the more that individual loan officer is required to do.” She added that she expects to see loans coming from the Blytheville and Osceola area thanks to the coming of Big River Steel. For the future, Nelson said the SBA lending program will continue to face challenges. “A couple of our strongest banks in the state are so caught up now in acquisitions, if you will,” she said. “Like Centennial had been a big player, but their numbers have dropped off.” But it’s still a challenge to deal with those banks, she said, because they often must change systems post-acquisition, which means they won’t “be looking at SBA lending as much as we hope they will,” Nelson said. “In the meantime, we’ve seen interest from some with an already-settled footprint,” she said. “Like First Service at Greenbrier showed some interest and has set up somewhat of an SBA department. That is the model that works best.” Article by Luke Jones, Arkansas Business. Read more here: SBA Lending in Arkansas Rises in 2013